Insolvency Services

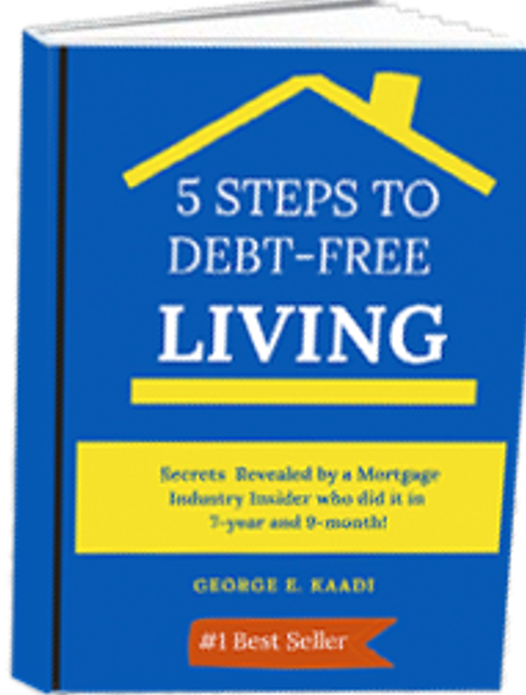

From Debt Burden to Financial Health: George Kaadi's Canadian Insolvency Expertise.

Facing financial challenges can be overwhelming, but George Kaadi, an experienced financial advisor, specializes in Canadian insolvency services, offering individuals and businesses a path toward financial recovery and a fresh start. With George's expertise, clients can navigate the complexities of insolvency with confidence and take steps toward rebuilding their financial health.

George Kaadi's commitment to Canadian insolvency services is rooted in his dedication to helping individuals and businesses overcome financial challenges and move toward a brighter financial future. With his guidance, clients can regain control of their finances, alleviate the burden of debt, and take proactive steps toward lasting financial stability.

Guiding You Through Financial Recovery

George Kaadi understands the sensitive nature of financial difficulties and provides compassionate support while offering effective solutions for insolvency-related issues.

Financial Assessment: George conducts a comprehensive financial assessment to understand the extent of your financial challenges and to identify the most suitable insolvency solutions.

Consumer Proposals: For individuals struggling with unmanageable debt, George assists in creating consumer proposals—a formal legal process that offers debt relief by negotiating reduced payments with creditors while allowing you to retain assets.

Bankruptcy Services: If bankruptcy is the most appropriate solution, George guides clients through the bankruptcy process, ensuring that all legal requirements are met and helping clients understand their rights and responsibilities.

Debt Consolidation: George offers strategies for consolidating and managing high-interest debts, providing clients with options to regain control of their finances.

George Kaadi understands the sensitive nature of financial difficulties and provides compassionate support while offering effective solutions for insolvency-related issues.

Financial Assessment: George conducts a comprehensive financial assessment to understand the extent of your financial challenges and to identify the most suitable insolvency solutions.

Consumer Proposals: For individuals struggling with unmanageable debt, George assists in creating consumer proposals—a formal legal process that offers debt relief by negotiating reduced payments with creditors while allowing you to retain assets.

Bankruptcy Services: If bankruptcy is the most appropriate solution, George guides clients through the bankruptcy process, ensuring that all legal requirements are met and helping clients understand their rights and responsibilities.

Debt Consolidation: George offers strategies for consolidating and managing high-interest debts, providing clients with options to regain control of their finances.

Business Insolvency:

George provides tailored solutions for businesses facing financial distress, helping them navigate corporate restructurings, proposals, and other insolvency-related strategies.

Credit Counseling: George provides credit counseling and financial education to help clients make informed decisions and develop responsible financial habits.

Legal Support: George collaborates with legal experts to ensure that insolvency proceedings are carried out smoothly and in compliance with Canadian insolvency laws.

Rebuilding Credit: George offers guidance on rebuilding credit and re-establishing financial health post-insolvency, helping clients regain their financial footing.

Ongoing Support: George remains accessible to clients throughout their insolvency journey, offering continuous support and advice as they work toward financial recovery.

Credit Counseling: George provides credit counseling and financial education to help clients make informed decisions and develop responsible financial habits.

Legal Support: George collaborates with legal experts to ensure that insolvency proceedings are carried out smoothly and in compliance with Canadian insolvency laws.

Rebuilding Credit: George offers guidance on rebuilding credit and re-establishing financial health post-insolvency, helping clients regain their financial footing.

Ongoing Support: George remains accessible to clients throughout their insolvency journey, offering continuous support and advice as they work toward financial recovery.